real property gain tax 2017

If Land or house property is held for 36 months or less 24 months or less wef. Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time.

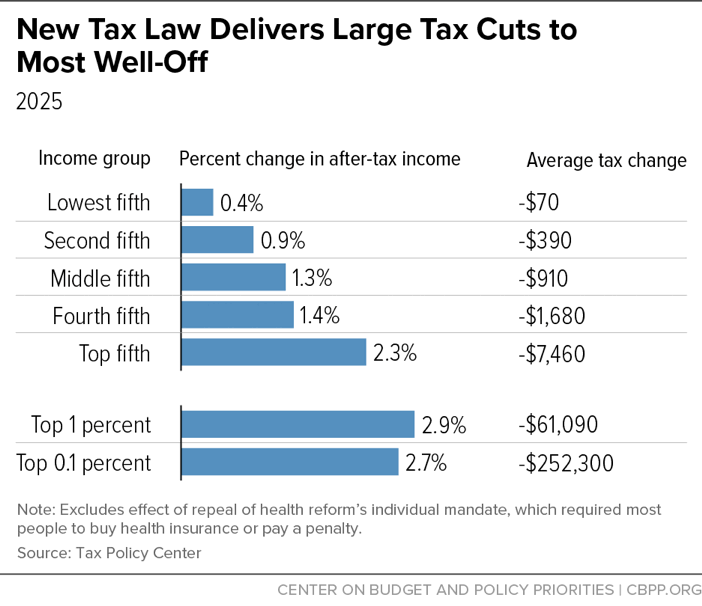

State Taxes On Capital Gains Center On Budget And Policy Priorities

The rules concerning basis and gain on repossessed real property are mandatory.

. An exchange of real property held primarily for sale still does not qualify as a like-kind exchange. The original income tax choice from the. Enter it on line 5b of Schedule A Form 1040 212.

Divide line 2 by 365 366 if leap year 0342. A domestic or foreign partnership the trustee of a domestic or foreign trust or the executor of a domestic or foreign estate shall be required to deduct and withhold under subsection a a tax equal to 15 percent of the fair market value as of the time of the taxable distribution of any United States real property interest distributed to a partner of the partnership or a beneficiary. Exception for substantially appreciated property.

Local filemaster file 2017. Management indicates the need for real estate to be cared for and monitored with accountability for and attention to its useful life and condition. Environmentally related tax revenue accounts.

Founded in 1998 Fortress manages assets on behalf of over 1900 institutional clients and private investors worldwide across a range of credit and real estate private equity and. FY 2017-18 then that Asset is treated as Short Term Capital Asset. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. View Property Information and Pay Taxes Online. The return may consist of a gain profit or a loss realized from the sale of a property or an.

You performed more than 750 hours of services during the tax year in real property trades or businesses in which you materially participated. Number of days in the real property tax year that you owned the property. This can include residential commercial and land real estate.

The history of taxation in the United States begins with the colonial protest against British taxation policy in the 1760s leading to the American RevolutionThe independent nation collected taxes on imports whiskey and for a while on glass windowsStates and localities collected poll taxes on voters and property taxes on land and commercial buildings. Subpara 16711aii the supply of real property is a taxable supply by way of lease licence or similar arrangement. If property was acquired on an exchange described in this section section 1035a section 1036a or section 1037a then the basis shall be the same as that of the property exchanged decreased in the amount of any money received by the taxpayer and increased in the amount of gain or decreased in the amount of loss to the taxpayer that was recognized on such exchange.

Exchanges started in and completed after 2017. Qualified investment entities QIEs. The Securities and Exchange Commission said Mattel Inc.

Investment requires a sacrifice of some present asset such as time money or effort. A transition rule in the new law provides that Section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before December 31 2017 or received replacement property. Lines 5a5dGains and Losses on the Dispositions of Property.

Disposition of REIT stock. Capital gains and losses are classified as long-term or short-term. Total real estate taxes for the real property tax year.

OECD-FAO Agricultural Outlook 2017-2026. A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA for the purpose of funding a new IRA for. Look-through rule for QIEs.

Line 5bNet Gain or Loss From Disposition of Property That Isnt Subject to Net Investment Income Tax. Furthermore if real property is supplied to the recipient under the terms of this election GSTHST will be payable if. Multiply line 1 by line 3.

OECD-FAO Agricultural Outlook 2017-2026. When you sell a capital asset the difference between the purchase price of the asset and the amount you sell it for is a capital gain or a capital loss. In January 2017 Hasbro invited Internet users to vote on a new set of game pieces with this new regular edition to be issued in March 2017.

Fortress Investment Group LLC is a leading highly diversified global investment manager with approximately 444 billion 12 of assets under management as of June 30 2022. Agreed to pay 35 million to settle claims over misstatements the toy maker made in its 2017 financial statements. Line 5aNet Gain or Loss From Disposition of Property.

Property management is the operation control maintenance and oversight of real estate and physical property. You must use them to figure your basis in. The two cheapest properties Baltic Avenue and Mediterranean Avenue.

Real property holding corporation. Real Property Tax Service Office. While a lot has been said about the 20 increase in property values many locations have enjoyed so far last year it must be remembered that the last peak for our property markets was in 2017 and in many locations housing prices stagnated before rising again amid the 2021 property boom.

If you have made a capital gain you will pay tax on the gain. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Main Menu Departments.

Unrivaled access premier storytelling and the best of business since 1930. It is made available for citizens to gain access to more information on their individual property as well as see information on taxes historical sales and pay taxes online. Real Property Gain or Loss.

Same Property Rule. Real estate renting and business activities By Size Class SDBS Structural Business Statistics ISIC Rev. Environmentally related tax revenue accounts.

The supply of real property is a taxable supply by way of sale and the recipient is not a. If you are a foreign resident and acquire an interest in Australian real property you must report any income from renting or selling the property in an Australian tax return and pay any tax owing. Net gain attributable to NUA in employer securities held by a qualified plan.

OECD-FAO Agricultural Outlook 1990-2027 by commodity. The gain is passive activity income if the fair market value of the property at disposition was more than 120 of its adjusted basis and either of the. Real Property Tax Service RPTS.

This is your deduction. The values on the board reflect real estate property values of 1930s Atlantic City. Under the Tax Cuts and Jobs Act a trade is not a like-kind exchange unless the taxpayer trades and receives real property other than real property held primarily for sale.

In finance the purpose of investing is to generate a return from the invested asset.

An Overview Of Capital Gains Taxes Tax Foundation

How Do State And Local Property Taxes Work Tax Policy Center

Capital Gains Tax Guide Napkin Finance

Gl Property Consultancy Real Property Gains Tax Rpgt Is A Form Of Capital Gains Tax That Homeowners And Businesses Have To Pay When Disposing Of Their Property In Malaysia This Means

The Capital Gains Tax Rate What You Need To Know For 2017 The Motley Fool

Solved Question 2 Clo 1 On The Occasion Of His Wedding Chegg Com

Soh Tax Review Commission 09 15 2021 Youtube

Samantha Jacoby On Twitter And Married Couples With Up To 80 000 In Income Who Account For 70 Of Households Already Pay A 0 Tax Rate On Capital Gains So They Would Get

Income Tax And Capital Gains Rates 2017 04 01 17 Skloff Financial Group

The Tax Impact Of The Long Term Capital Gains Bump Zone

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Capital Gains Tax In The United States Wikipedia

State Taxes On Capital Gains Center On Budget And Policy Priorities

Long Term Capital Gains Tax Rates In 2017 The Motley Fool

Short Term And Long Term Capital Gains Tax Rates By Income

Five Things To Know To Reduce Your Tax On Capital Gains Woburn Ma Estate Planning And Elder Law

Fillable Online Tax Ny Form It 2663 2017 Nonresident Real Property Estimated Income Tax Ny Fax Email Print Pdffiller

How To Avoid Capital Gains Tax When You Sell A Rental Property

Comments

Post a Comment